One week ago, Barclays

announced

the suspension of issuance of new creation units as well as sales from

inventory for two of its ETNs: the iPath Series B S&P 500 VIX Short-Term

Futures ETN (VXX);

and the iPath Pure Beta Crude Oil ETN (OIL).

The purpose of

this post is to explain the risks for both long and short holders of VXX and to

get a sense of how this story is likely to play out.

First of all,

the announcement came before regular trading hours on March 14th and

during the entire session, VXX traded at a premium of up to 3.28 points relative

to its intraday

indicative value (IV), as captured in a graphic in Barclays

Suspends Creation Units for VXX. By

the end of the day, VXX was trading at a 1.73 point premium to indicative value -- which is what VXX would be trading at if new creation units were still enabled.

It wasn’t until

March 15th that the fireworks begin.

That morning, VXX opened up another 2.08 points at 30.89, up 6.7% from the

previous day’s close. Right from the

open there was some intense buying pressure that resulted in a short squeeze, with VXX briefly spiking as high as 41.65, up 44.6% from the previous day’s

close. That short squeeze was retraced

over the course of the day and by the end of the session, VXX was down 0.11 on

the day. The action during the last five

days has been relatively uneventful, though the volume in VXX has dropped

approximately 90% from a pre-suspension average of about 50 million shares per day

to less than 5 million today. As of

today’s close, VXX was at 25.44, some 3.93 points (15.4%) over indicative

value.

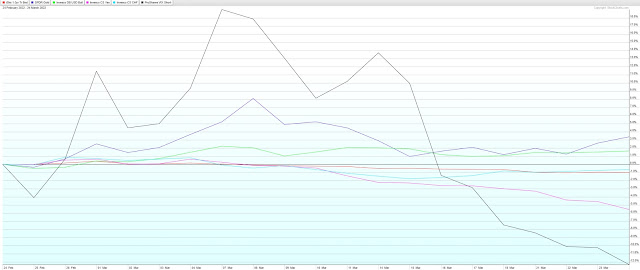

The chart below

captures the journey of VXX relative to indicative value (VXX.IV) in the seven

days going back to the original announcement of the suspension of new creation

units. Note that for the last week, the

VXX premium relative to VXX.IV has been in a range between 1.50 and 5.00, with

that early short squeeze premium of 15.11 now firmly in the rear-view

mirror. At various times it appeared

that traders had settled on 3.50 or 4.00 as an appropriate amount of premium

for VXX in the absence of new creation units that could be used to arbitrage

the price of VXX back down to VXX.IV.

The big questions

are what to expect going forward and what are the risks to both long and short

holders of VXX. At the risk of stating

the obvious, nobody outside of Barclays knows what will happen going forward,

but Barclays described their move as a temporary suspension of creation units. With VXX having assets of $729 million and a fee of 0.89%

per year, Barclays has an incentive to find a solution for the creation units

problem – and whatever is behind it – so that they can collect their $6.5

million annual fee from this product.

Credit Suisse was able to resolve a similar problem with the suspension TVIX

new creation units in a month and a day back in 2012. Barclays and VXX have been at this game

longer than anyone else, with an initial launch of VXX back on January 30, 2009. They have had 13 years to prepare for the present

situation, which is likely a least partly related to hedging risks and costs

associated with how Vladimir Putin proceeds with the invasion of Ukraine. I expect they will find a solution to the new

creation units problem in relatively short order, but I have no insight into

whether this will be a matter of days or weeks.

Going forward, both

longs and shorts have to expect that Barclays will bring VXX creation units

back and when they do, the VXX premium relative to VXX.IV is likely to

disappear almost instantly. Truth be

told, when Credit Suisse brought back creation units in TVIX back in 2012, it

took two days for most of the indicative value premium to be wiped out, but those

days were excruciating losses of 29.3% and 29.8% that left investors reeling

and confused. This time around the

premium at risk of another new creation units air pocket is “only” 15.4% -- but

there is very little to prevent this number from growing much larger.

This brings us

to the other side of the equation. How

much higher can a short squeeze take VXX?

While 90% of the daily volume in VXX has evaporated in the past seven

days, the current 5 million shares per day will likely have to shrink

considerably more before a short squeeze has much in the way of potential

staying power. The DGAZ story from 2020

is a stark reminder that not only is it theoretically possible to see a spike

of 12,000%, but such a spike has recently happened. The problem for longs is that in waiting for

a potential short squeeze, each day brings them one day closer

to the seemingly inevitable announcement of a restoration of creation units and a 15.4%

contraction in the price of VXX. In

addition to that potential 15.4% haircut, long holders should also keep in mind

that VXX has lost an average of 56% per year going back to 2009 due to

structural weaknesses such as contango,

negative roll

yield and daily compounding decay (which I have summarized in posts such as

Four

Key Drivers of the Price of TVIX), so time is not on the side of VXX longs.

In summary, the

risk for shorts is the potential for a successful short squeeze along the lines

of the DGAZ fiasco. As volume in VXX

decreases, which is likely to be the case until Barclays resolves the new creation

units issue, the risk of a short squeeze rises.

On the other hand, the risk for longs is the resumption of new creation

units almost immediately wiping out the premium over indicative value. Both longs and shorts are likely to see their

risks go up over time. For VXX short,

the assumption is that volume will continue to go down over time, increasing

the risk of a short squeeze. For VXX

longs, the risk is that a solution to the creation units problem is just

around the corner and could be announced at any time. An announcement is unlikely to come out

during the trading day, but overnight risk should be treated as considerably

higher than intraday risk.

This situation is exactly the type of “jump risk”

(or gap risk) that makes options an attractive way to structure a trade – either

on the long or short side. That said,

note that implied volatility in VXX options is presently at an elevated level

of 102, making outright purchases of VXX puts and calls expensive in

the current environment.

I should note

that VXX long holders may also be subject to acceleration risk, which means

that this product is subject to early redemption or an “accelerated” maturity

date, at which point the ETN would be redeemed at indicative value (VXX.IV)

not at the current market price. For

more information on the risks associated with ETNs, FINRA has a good

summary of the issues.

Last but not

least, I should mention that the OIL ETN that had

its creation units halted at the same time as VXX has seen very little in the

way of premium over indicative value, with the biggest exception being a

smaller squeeze/spike on the second day that coincided with the big spike in

VXX. Right now, the premium in OIL is a

mere 0.03. This does not mean that the

Reddit wallstreetbets

crowd will not suddenly pile into the OIL trade in an effort to squeeze the

shorts in a lower volume name, but so far at least, the WSB crowd does not see

OIL in the same way they saw the VXX

or Opportunity of a Lifetime trade.

So, whether you

are long or short VXX, understand the risks associated with your position and

the time and volume factors also at work.

For those who insist on trading this name, consider structuring

positions as defined-risk options trades.

In the graphic

below, I show the premium of VXX to VXX.IV over the course of the last seven

days, using 30-minute bars.

[source(s): Yahoo, TD Ameritrade, VIX and More]

Further Reading:

Barclays Suspends Creation Units for VXX

Attempt at TVIX Short Squeeze Fizzling Out

The Resurrection of TVIX

TVIX Premium to Indicative Value Creeping Back Up

TVIX Creation Units Return; What It Means for Investors

Is TVIX Now Just a More Docile UVXY?

Recent TVIX Volume and VIX Futures Volume

The Story of VIX ETPs Relative to their Intraday Indicative Values

The Ups and Downs of the New Premium in TVIX

Credit Suisse Suspends Creation Units in TVIX: What it Means

Four Key Drivers of the Price of TVIX

Will TVIX Go to Zero?

TVIX Topples VXX as Highest Volume VIX ETP

Who Is Trading TVIX?

Volatility Becomes Unhinged on Friday

TVIX Finally Getting Its Due As Day Trading Rocket Fuel

TVIX Trades One Million Shares for First Time

All About UVXY

While it has not been updated in a while, new readers may also enjoy older posts that have been tagged with the Hall of Fame label.

For those who may be interested, you can always follow me on Twitter at @VIXandMore

Disclosure(s): net short VXX at time of writing